GST Registration

Easily GST Register with LegalMate Experts

GST registration is now mandatory in India. LegalMate offers you register your business under goods and services tax (GST) easily. Get GST register today.

- GST Registration in 7 days by top experts

- 100% online service with money back guarantee

- Transparent process, thorough follow up and regular updates

🌟🌟🌟🌟🌟 4.9/5.0 | 10000+ Happy Clients

Information Required For Apply GST Registration

Business Details

ID and proof of address

Valid Documents

Valid Documents for GST registration are need. In case of Company/LLP or it would require all necessary documents. Our expert will guid you about documents according to your business registration.

Talk To A GST Expert

Our GST Registration Pricing

Get your GST register hassle-free with our special package! Hurry, limited-time offer – lowered prices for your benefit, Apply for GST

Proprietor

- GST Registration

- GST Certificate

- Bank Account Listing

- 24/7 Legal Support

Startup

- GST Registration

- GST Certificate

- GST Account Setup

- Bank Account Listing

- 24/7 Legal support

Company / LLP

- GST Registration

- GST Certificate

- Authorised Letter Drafting

- Free Consent Letter

- GST Steup

- Current Account Listing

- Money Back Guarantee

- 24/7 support

All in One Solution

Tax & GST Return Filing Manage

Are you looking for a seamless solution to manage your tax and GST return filing? Look no further! Our comprehensive tax management system is designed to streamline your tax processes and ensure compliance with ease.

Understanding Goods and Services Tax (GST) in India

GST registration is a crucial step for businesses operating in India, as it is mandatory for those whose turnover exceeds the prescribed threshold. This registration enables businesses to collect and remit GST, ensuring compliance with tax regulations.

Relax and focus on your entrepreneurial dreams while LegalMate takes care of the legal details. With LegalMate, setting up your new business becomes easy and enjoyable.

Eligibility Criteria for GST Registration

To qualify for GST registration, businesses must meet certain criteria, including:

- Turnover Threshold: Businesses with an annual turnover exceeding Rs. 20 lakhs (Rs. 10 lakhs for northeastern states) are required to register under GST.

- Interstate Supply: Entities engaged in interstate supply of goods or services are also mandated to register for GST, irrespective of their turnover.

Benefits of GST Registration

Registering under GST offers several advantages, such as:

- Legal Compliance: GST registration ensures legal compliance with tax laws, avoiding penalties and legal hassles.

- Input Tax Credit: Registered businesses can claim input tax credit on purchases, reducing overall tax liability.

- Business Credibility: GST registration enhances business credibility, especially for B2B transactions.

- Access to Wider Market: Registered businesses can participate in interstate trade without restrictions.

Documents Require For GST Registration In India

| Document | Copies |

|---|---|

| PAN Card of Proprietor | 1 |

| Aadhaar Card of Proprietor | 1 |

| Passport Size Photo | 1 |

| Business Address Proof | 1 |

| Document | Copies |

|---|---|

| Pan Card (Directors) | 1 |

| Aadhaar Card (Directors) | 1 |

| Passport Size Photo (Directors) | 1 |

| Certificate of Incorporation | 1 |

| MOA & AOA | 1 |

| Board Resolution | 1 |

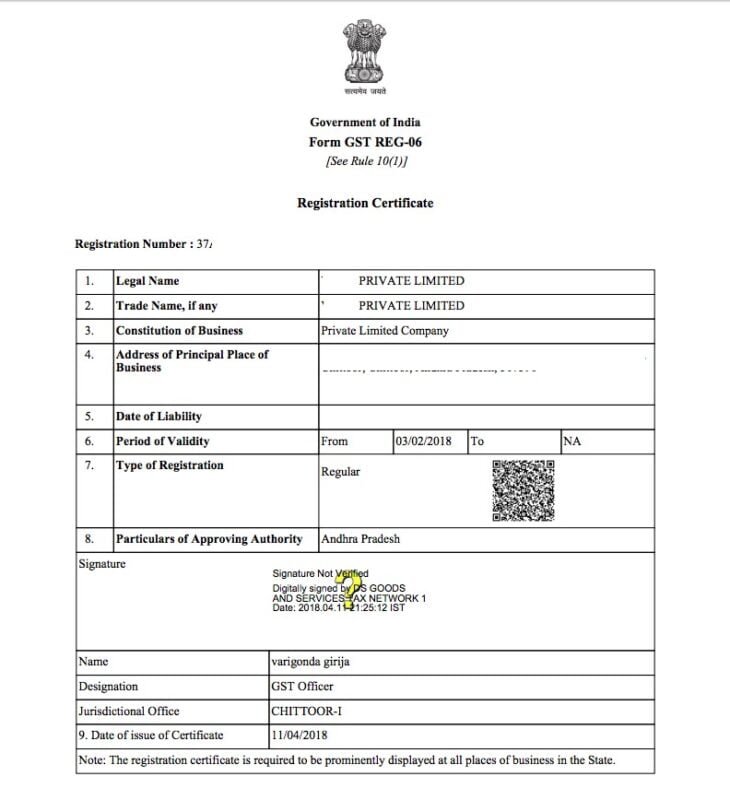

Process of GST Registration

The process of GST registration involves the following steps:

- Preparation of Documents: Gather necessary documents such as PAN card, Aadhaar card, business registration proof, bank statements, etc.

- Online Application: Visit the GST portal and fill out the online application form with accurate details.

- Verification: Once the application is submitted, it undergoes verification by the GST authorities.

- Issuance of GSTIN: Upon successful verification, a unique GST Identification Number (GSTIN) is issued to the applicant.

- Filing Returns: Registered businesses must regularly file GST returns to maintain compliance.

Importance of Professional Assistance

While the process of GST registration may seem straightforward, seeking professional assistance can ensure accuracy and efficiency. LegalMate India offers expert guidance throughout the GST registration process, ensuring a seamless experience for businesses.

Why Choose LegalMate for Online GST Registration?

Trusted and Top Rated

Partner with us for reliable legal solutions.

Reliable Lawyers & Accountants

Dependable legal solutions for your business.

Transforming Business Growth

Transforming Finances with Expert Accounting.

Online & Offline Service

Integrated online & offline legal service.

Frequently Asked Questions

GST registration is the process of registering a business under the Goods and Services Tax (GST) regime in India. It is mandatory for businesses whose turnover exceeds the prescribed threshold.

Any business with an annual turnover exceeding the prescribed threshold (as of 2021, it is Rs. 20 lakhs for regular businesses and Rs. 10 lakhs for special category states) must register for GST.

You can register for GST online through the official GST portal (www.gst.gov.in). The process involves providing necessary documents and details about your business.

The Composition Scheme is for small businesses with turnovers up to a specific limit. They can pay a fixed percentage of turnover as tax and are subject to simpler compliance requirements.

Yes, e-commerce sellers are required to register for GST, regardless of their turnover, and must collect and remit GST on sales made through their platforms.

GST registration must be completed within 30 days from the date when a business becomes liable to register. Failure to do so can result in penalties.

Yes, GST registration can be cancelled under certain circumstances, such as cessation of business activities or turnover falling below the threshold limit. The cancellation process involves submitting an application on the GST portal.

Professional services providers like LegalMate India offer expert guidance and support for GST registration, ensuring a smooth and compliant process for businesses.

(+91) 8934042222

legalmateindia@gmail.com

View Map