Under the products and Services Tax (GST) regime in India, the eway bill is essential for maintaining transparency and expediting the flow of products. This electronic document acts as a permit for the interstate and intrastate transportation of commodities above a certain value threshold. Businesses may handle the eway billing procedure effectively and guarantee trouble-free product shipping by being aware of its nuances.

What is an E-Way Bill?

An eway bill is an electronic document generated on the official e-way bill portal (https://ewaybillgst.gov.in/) or through integrated applications. It acts as a digital permit for the movement of goods valued at more than ₹50,000 (Indian Rupees).

What Eway Bill Contains?

Important information regarding the consignment is provided in this document, including:

- Description of the goods

- Value of the consignment

- Name and GST Identification Number (GSTIN) of the supplier (consignor)

- Name and GSTIN of the recipient (consignee)

- Origin and destination of the goods

- Transporter details (if applicable)

When is an E-Way Bill Required?

E-way bill generation is mandatory for the movement of goods exceeding ₹50,000 in the following scenarios:

- Inter-state movement: Transportation of goods between two different states in India.

- Intra-state movement: Transportation of goods within the same state.

Why Eway Billing Matters

Eway billing is important because it:

- Makes sure taxes are paid correctly.

- Helps manage logistics better.

- Makes it easier to do business across different states.

- Improves how businesses work by keeping things transparent.

Benefits of E-Way Billing

E-Way billing helps businesses in several ways:

- Transparency: It makes the movement of goods clear and easy to track.

- Efficiency: By streamlining the billing process, it saves time and reduces errors.

- Compliance: It ensures businesses follow tax regulations, avoiding penalties.

- Cost Savings: Efficient logistics mean lower costs for businesses.

- Improved Record-Keeping: E-Way bills provide a digital record of transactions, making it easier to manage business operations.

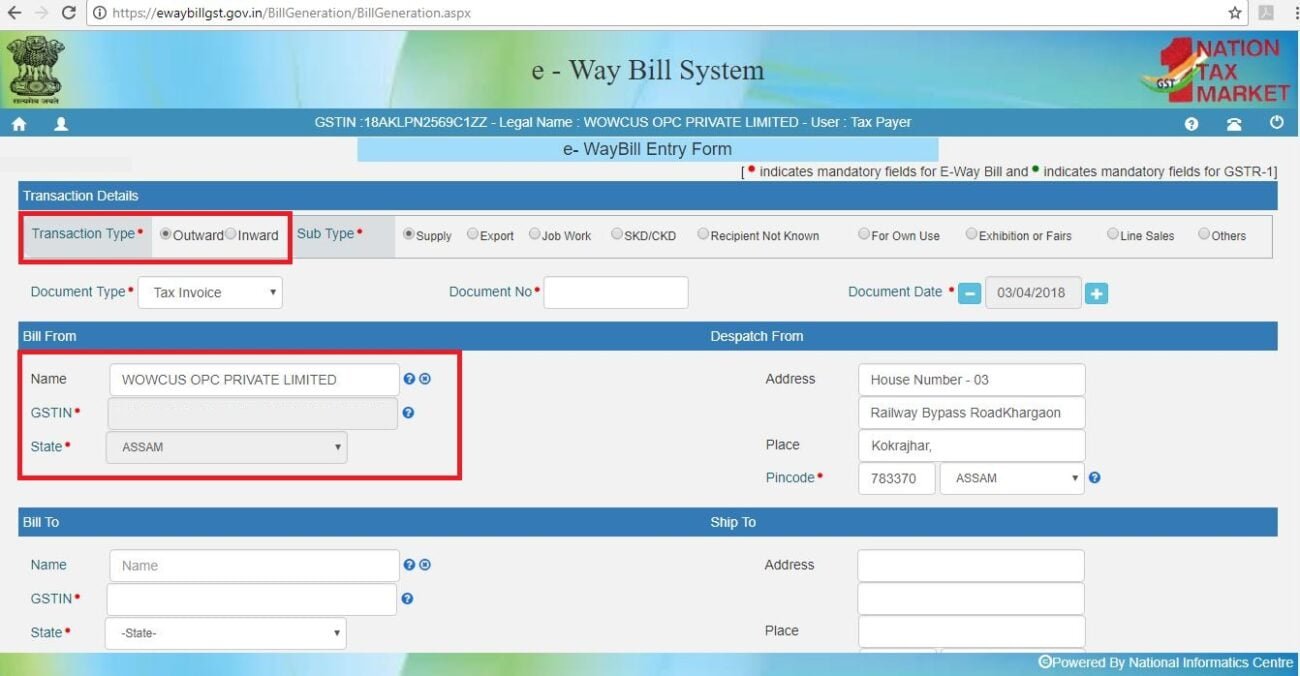

How to Make an Eway Bill

- Visit the official e-way bill portal (https://ewaybillgst.gov.in/) and register using your GSTIN. (If don’t have GST? Register it through LegalMate)

- Login to the portal and navigate to the “E-waybill” section.

- Click on “Generate New” and enter the required details about the consignment.

- Once all details are entered, validate and submit the information.

- The system will generate the e-way bill, which you can download and print for your records.

Does Service Provider Need to Generate Eway Bill?

No e-way bill needed for service businesses! E-way bills are for goods movement, not services (unless goods are a major part of the service).

Difference Between E-way Bill and Invoice India

Both e-way bills and invoices are important documents in the Indian GST regime, but they serve distinct purposes:

E-Way Bill:

- Purpose: Permits goods transportation exceeding ₹50,000 within or across states.

- Captures: Consignment details, transporter info.

- Generated by: Supplier, recipient, or transporter with valid GSTIN.

- Validity: Time-bound based on distance.

- Benefits: Enhances transparency, simplifies compliance, improves logistics.

Invoice:

- Purpose: Records sale transactions between supplier and recipient.

- Captures: Goods/services details, price, tax, supplier/recipient info.

- Generated by: Mandatory for all registered businesses for each sale.

- Validity: No expiry, used for tax records.

- Benefits: Facilitates record-keeping, supports input tax credit claims, aids in dispute resolution.

Key Differences:

- Focus: E-way bill for goods movement, invoice for sale.

- Mandatory for: E-way bill for specific goods, invoice for all registered businesses.

- Validity: E-way bill has a time limit, invoice is a permanent record.