GST Registration in Lucknow, Uttar Pradesh

Fastest Online GST Registration by Top GST Lawyer

GST registration is now mandatory for all business in Lucknow, Uttar Pradesh. Register your GST online through LegalMate’s top GST Lawyers near you. We provide fastest GST certificate in 7 Days.

- GST Registration in 10 days by top experts

- 100% online service with money back guarantee

- Transparent process, thorough follow up and regular updates

🌟🌟🌟🌟🌟 4.9/5.0 | 10000+ Happy Clients

Information Required For GST Registration In Lucknow

Business Details

Business Address

ID and proof of address

Best GST Registration Service in Lucknow, Uttar Pradesh

Hey there, if you’re a business owner in Lucknow, we’ve got great news for you! We’ve made the Goods and Services Tax (GST) registration process super easy for you. With our online GST registration in Lucknow, you can get GSTIN Number with your GST Certificate without any hassle.

Our team in Lucknow is here to guide you every step of the way. We’ll help you get your GST registration done smoothly, so you can focus on what you do best – running your business.

Why wait? Let’s kickstart your GST registration process today! Join us, and let’s make your business journey in Lucknow even better.

Our GST Registration Packages

Get your GST registered hassle-free with our special package! Hurry, limited-time offer – lowered prices for your benefit

GST For Proprietor

Register your business under good and service tax in Lucknow as Proprietor.

₹2500

GST For Company/LLP

GST registration is now mandatory for company in Lucknow. Avail Benefits from GST.

₹3999

GST For Partnership

Get GST Registration for your partnership firm and it will helping to open current account.

₹2999

Documents Required For GST Registration In Lucknow, UP

There are a few documents that are mandatory for the GST process. The list is below mentioned.

Sole proprietor / Individual

- PAN card of the owner

- Aadhar card of the owner

- Photograph of the owner (in JPEG format, maximum size – 100 KB)

- Bank account details*

- Address proof**

LLP and Partnership Firms

- PAN card of all partners

- Copy of partnership deed

- Photograph of all partners and authorised signatories

- Address proof of partners (Passport, driving license, Voters identity card, Aadhar card etc.)

- Aadhar card of authorised signatory

- Proof of appointment of authorized signatory

- In the case of LLP, registration certificate / Board resolution of LLP

- Bank account details*

- Address proof of principal place of business

Hindu Undivided Family

- PAN card of HUF

- PAN card and Aadhar card of Karta

- Photograph of the owner (in JPEG format, maximum size – 100 KB)

- Bank account details

- Address proof of principal place of business

Company (Public and Private) (Indian and foreign)

- PAN card of Company

- Certificate of incorporation

- Memorandum of Association

- Articles of Association

- PAN card and Aadhar card of authorized signatory.

- PAN card and address proof of all directors of the Company

- Photograph of all directors and authorised signatory

- Board resolution appointing authorised signatory

- Bank account details

- Address proof of principal place of business

Don’t Hesitate To Ask, We are ready to advice you

Online GST Registration in Lucknow

Understand GST Registration

GST, or Goods and Services Tax, is the cornerstone of modern taxation in India. It’s a unified tax that replaces a host of indirect taxes, making life easier for businesses. And GST registration? Well, that’s your entry ticket to this streamlined tax system.

GST Registration Mandatory For Business

GST registration is mandatory when your business exceeding a specific threshold (as per GST laws). You must get GST registered. But hey, even if you’re below that limit, you can voluntarily register—it’s a smart move!

Benefits of GST Registration in Lucknow

Lower Taxes: Many items are tax-free or have a low 5% tax rate.

Helping the Needy: The less fortunate will get more benefits.

Fair for Small Traders: Small businesses have a fair chance to succeed.

Less Complicated Taxes: Taxes are easier to understand.

No Borders for Goods: Products and services can move freely across India.

Competition Benefits: More competition means better prices for consumers.

Affordable Goods: Things like movie tickets, two-wheelers, TVs, and cars are cheaper now.

Who Needs GST Registration in Lucknow?

Turnover Limit: If your yearly sales are over Rs. 20 lakhs (or Rs. 10 lakhs in special states), you need GST registration.

International Business: If you sell goods or services abroad.

Online Sales: If you sell things online, like on Flipkart, Amazon, or Jio Store.

Previous Tax Registration: If you were registered under VAT, Excise Laws, or Service Tax Laws.

Operating in Multiple States: If your business spans across different states.

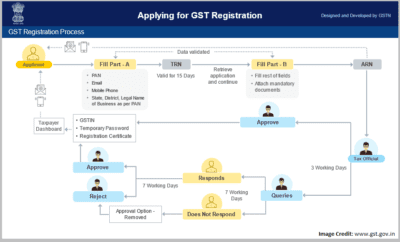

Procedure for GST Registration in Lucknow

Get in Touch: Fill out the contact form on our website, or call us directly using the provided numbers.

Assigned Expert: An expert will be assigned to guide you through the process.

Document Gathering: Collect all the necessary documents required for GST registration.

Document Submission: Your documents will be submitted to the GST portal after verification.

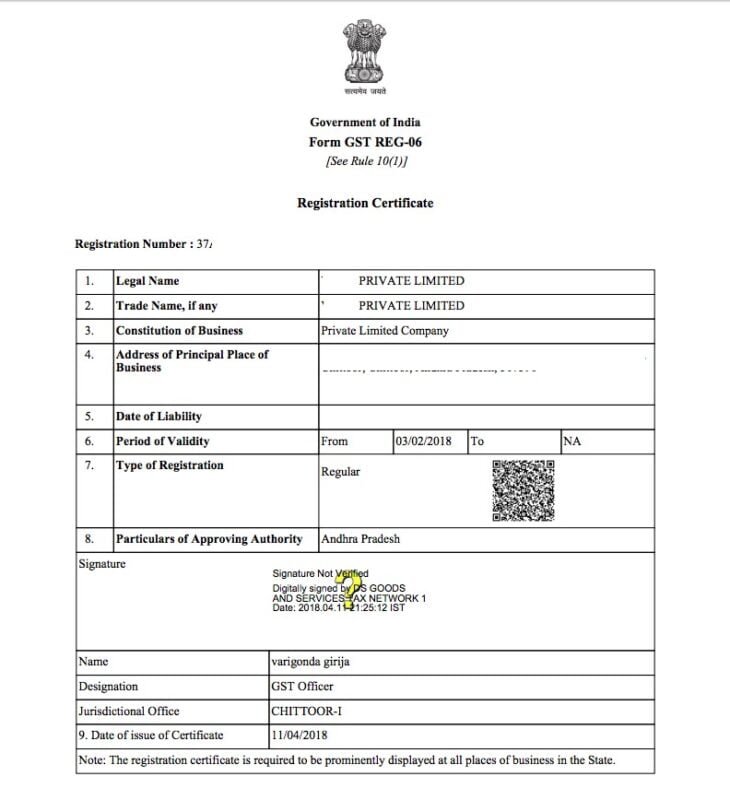

ARN Number: An Application Reference Number (ARN) will be generated for your application.

GSTIN Arrival: Within 2-7 working days, you’ll receive your GST Identification Number (GSTIN) via email.

Why Chose LegalMate India For GST Registration?

Trusted and Top Rated

Partner with us for reliable legal solutions.

Online & Offline Service

Integrated online & offline legal service.

Transforming Business Growth

Transforming Finances with Expert Accounting.

Reliable Lawyers & Accountants

Dependable legal solutions for your business.

Frequently Asked Questions

Our Client Services Team is always happy to help you with any questions about our GST Registration Service.

Call us on +918934042222 or email legalmateindia@gmail.com

Any business with an annual turnover exceeding the prescribed threshold (as of 2021, it is Rs. 20 lakhs for regular businesses and Rs. 10 lakhs for special category states) must register for GST.

You can register for GST online through the official GST portal (www.gst.gov.in). The process involves providing necessary documents and details about your business.

Documents such as PAN card, Aadhaar card, proof of business registration, address proof, bank account details, and authorized signatory details are typically required for GST registration.

Yes, businesses with turnovers below the threshold can voluntarily register for GST. This can provide benefits like input tax credit and formal recognition.

Yes, if you have business operations in different states, you need to obtain separate GST registration for each state where you operate.

The Composition Scheme is for small businesses with turnovers up to a specific limit. They can pay a fixed percentage of turnover as tax and are subject to simpler compliance requirements.

No, input tax credit is only available to registered businesses. If you are not registered under GST, you cannot claim input tax credit.

Yes, e-commerce sellers are required to register for GST, regardless of their turnover, and must collect and remit GST on sales made through their platforms.

GST registration must be completed within 30 days from the date when a business becomes liable to register. Failure to do so can result in penalties.

Yes, if you conduct business occasionally in a taxable territory where you don’t have a fixed place of business, you can opt for casual taxable person registration.