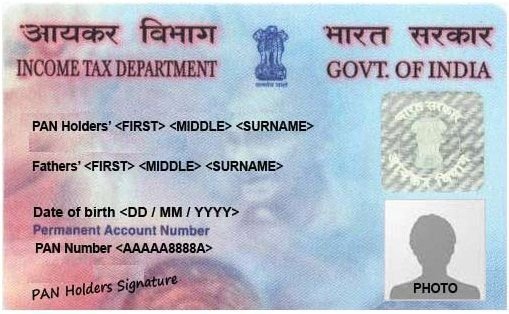

The Permanent Account Number (PAN) card is an essential document in India for anyone involved in financial activities. It acts as a unique identifier for income tax purposes, streamlining various financial transactions. This guide provides comprehensive information on PAN, from understanding their purpose to applying for and managing them.

What is a PAN?

A Permanent Account Number (PAN), issued by the Income Tax Department of India, is a ten-character alphanumeric identifier. It serves as your identity for tax purposes and is mandatory for various financial activities such as:

- Filing income tax returns

- Opening bank accounts

- Investing in mutual funds, stocks, and bonds

- Applying for loans

- Receiving taxable payments (above a certain limit)

- Registering a business

Benefits of Having a PAN Card

- Simplified Tax Filing: A PAN is essential for filing income tax returns electronically or manually.

- Financial Transactions: It facilitates various financial dealings, making them smoother and more transparent.

- Investment Tracking: The PAN helps track your investments across different institutions.

- Loan Applications: A PAN is mandatory for applying for loans from banks and other financial institutions.

- Government Benefits: It may be required to avail of certain government benefits and subsidies.

Who Needs a PAN Card?

- Indian Citizens: Any Indian citizen earning a taxable income or intending to engage in financial transactions mandating a PAN should apply for one.

- Resident Foreigners (Individuals and Entities): Foreign nationals residing in India for tax purposes or undertaking financial activities requiring a PAN must obtain one.

- Non-Resident Indians (NRIs): NRIs with income sourced from India need a PAN to file tax returns or claim tax refunds.

Types of PAN Cards

There are two main types of PAN:

- Physical PAN Card: This is the traditional laminated card containing your PAN details.

- e-PAN Card: This is a digital version of the PAN, issued in PDF format and considered equally valid as the physical card.

How to Apply for a PAN Card

You can apply for a PAN card online or offline:

Online Application:

- Visit the Income Tax Department’s e-filing portal (https://www.utiitsl.com/) or Protean eGov Technologies Limited (https://www.utiitsl.com/).

- Choose “New PAN Application” and fill out the online form with your details.

- Submit the form along with scanned copies of required documents.

- Pay the applicable fees online.

Offline Application:

- Download the PAN application form (Form 49A) from the Income Tax Department website.

- Fill out the form manually and attach the required documents (photographs, proof of identity, proof of address, and proof of date of birth).

- Submit the completed application form and documents to a PAN Service Provider like NSDL or UTIITSL.

- Pay the processing fee in cash or through a demand draft.

Documents Required:

- Identity Proof ( आधार (Aadhaar) card, Voter ID, Passport, etc.)

- Address Proof (Bank statement, utility bill, rental agreement, etc.)

- Date of Birth Proof (Birth certificate, school leaving certificate, passport, etc.)

- Two passport-sized photographs

PAN Card For Business

A PAN is a mandatory document for all businesses operating in India. It acts as your firm’s unique tax identification number, simplifying financial transactions and ensuring smooth tax filing.

- PAN For Partnership Firm

- PAN For NGO/Society/Association

- PAN For Company

LegalMate India help you to get pan card for business online in India. You can order online through this link.

Fees:

The application fee for a PAN varies depending on the applicant’s category (individual, company, etc.) and whether applying for a physical or e-PAN. You can find the latest fee structure on the Income Tax Department website.

Tracking PAN Card Application Status

Once you submit your PAN application, you can track its status online using the acknowledgment number provided on the application receipt. Both NSDL and UTIITSL offer PAN application status tracking facilities on their respective websites.

### Downloading e-PAN

If you applied for an e-PAN or have an existing PAN, you can download it from the websites of NSDL or UTIITSL. You will need your PAN details and acknowledgment number to download the e-PAN card.